92% of surveyed schools agreed with the following statement:

“CYPHER has transformed our institution, making it easy for teachers to create online classes and for students to stay engaged and have an enjoyable learning experience anytime, anywhere.”

Valuable capabilities of the #1 choice generative learning platform. Learn about AI, automation, gamification, course creation to delivery, and more.

Start tour

Everything from employee training to customer training, career growth to hybrid learning, certification to compliance, and more.

See solutions

Explore valuable best practices from CYPHER's customers, featuring insightful videos and expert advice.

See all

Create and deliver courses quicker. Reduce costs and reclaim your resources.

Watch now

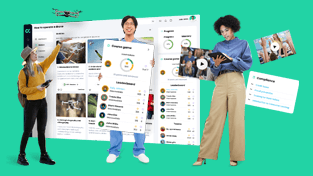

Need to engage students? Want more time to teach and connect with students? Struggling to track performance and progress? The CYPHER platform takes the chore out of learning and teaching. Our beautiful, intuitive, and AI-powered platform engages students, gives time back to teach and train, provides insights to drive better outcomes - all while keeping the human connection. Just the way modern learners expect.

Our human-centric approach is perfect for teachers, instructors, and administrators in schools, universities, colleges, and trade schools. From skills-based learning to sophisticated automation and leveled-up gamification to the intuitive interface - every aspect has been thoughtfully built to modernize and energize the way we live and learn.

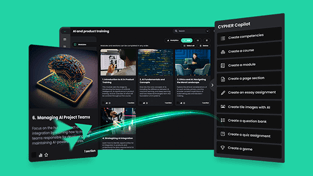

Using AI 360 with CYPHER Copilot, supercharge your class creation experience. Build multimedia, gamified, competency-based classes in minutes.

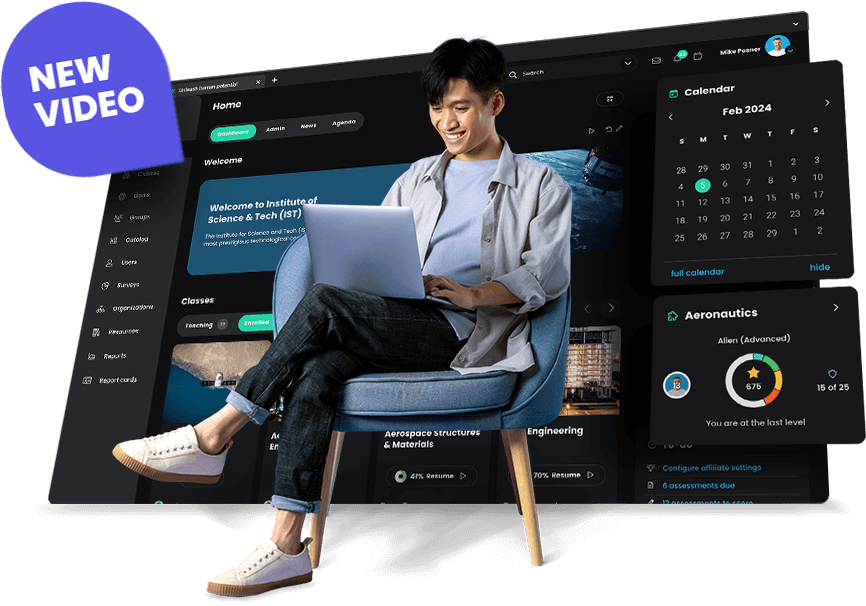

A comprehensive, modern learning platform built to unleash human potential.

Students have customized learning paths based on their digital profile and competencies they need to master. Get personalized learning at scale.

Automate class creation, gamification, assessments, etc. so you have more time to teach and connect with students.

Students can regularly up-skill, re-skill, and cross-skill with custom learning paths. We’re all about personalized learning that is tailored to the student.

Demonstrate learning ROI with skills competency and mastery. Make better decisions about your learning programs.

Our platform supports every student on their learning journey from kindergarten to college.

Build personalized classes and prepare students for real-world careers with the CYPHER platform.

From customer training to partner training to onboarding to mentorship to certification to compliance. We make it a reality.

“CYPHER has transformed our institution, making it easy for teachers to create online classes and for students to stay engaged and have an enjoyable learning experience anytime, anywhere.”

Survey of 153 clients using CYPHER

Teachers are the pillars of education. CYPHER's LMS helps them build high-quality classes and frees up their time so they can focus on having a greater impact on their students.

Students have broad academic expectations. Design learning that is fun, engaging, and prepares them for real-world careers.

Get a bird’s-eye view of the whole campus and how the overall teaching staff is performing to save time on administrative tasks, automate workflows, and supervise all school activities.

Survey of 150 clients of CYPHER

In the past year, we’ve received over two dozen awards for our innovative learning technology, including Forbes Advisor’s “Best Overall Employee Training Software” and “Best LMS.” We’ve also received recognition for our work in academia, earning the title of “Best K-12 Remote Learning Partner” in the SIIA CODiE 2022 Awards and numerous other awards.

We’ll help you get started

Full support on every step of the way

On-site training by our experts

Migrating your existing content

Creating custom content